For HDB Owners:

How To Potentially Retire In Your 50s With Your Current Property

Without Risking The Roof Over Your Head & Sacrificing The Lifestyle You Want

Without Risking The Roof Over Your Head & Sacrificing The Lifestyle You Want

Common misconceptions about retirement planning

1) I am still young, and can afford to think about retirement later

2) My CPF is sufficient for retirement

3) I will not have many expenses after I retire (eg: healthcare and leisure)

4) My savings will be Enough for My Retirement (eg: not taking into account inflation)

5) I don't plan to retire so soon.

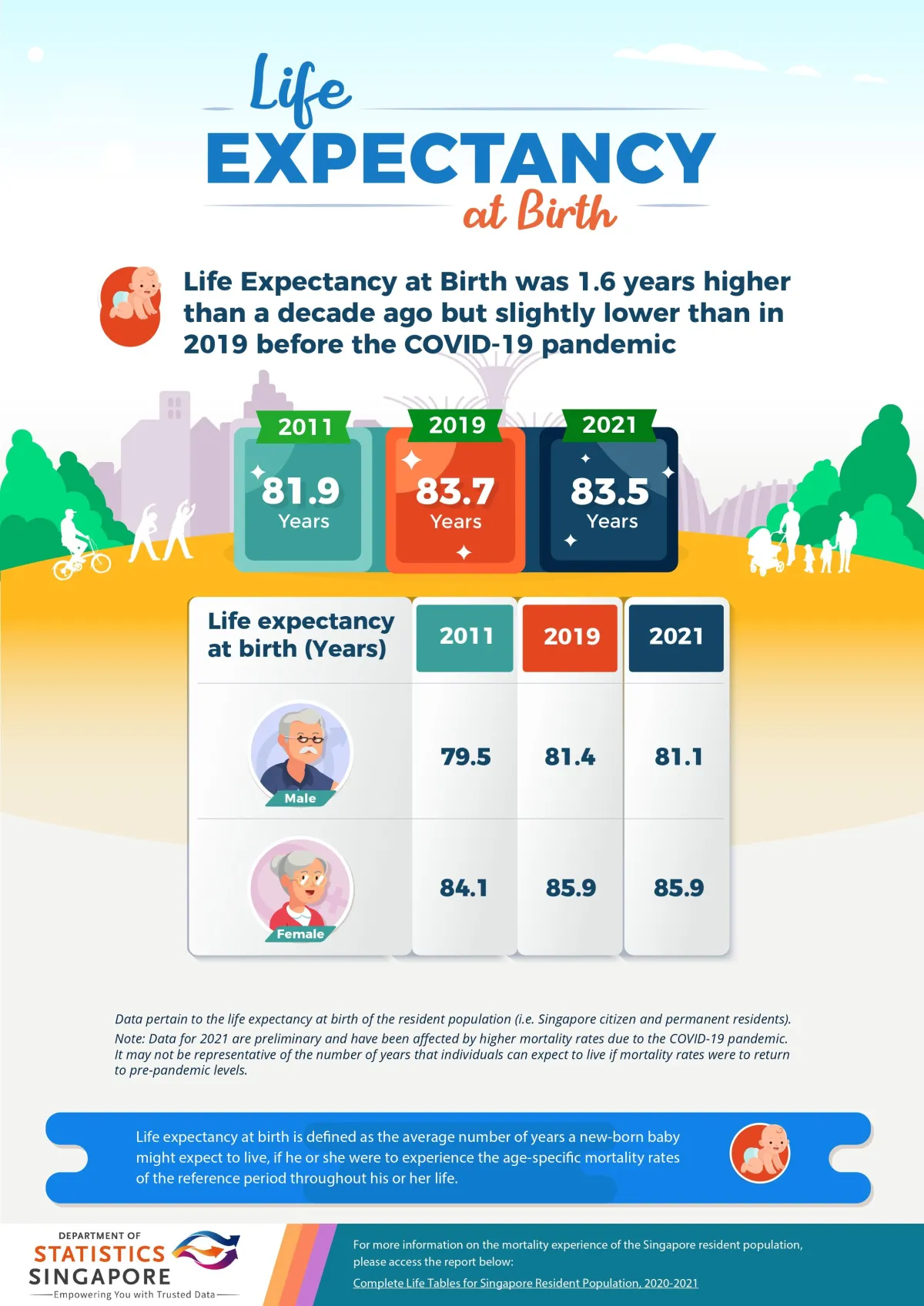

Life expectancy affects retirement planning

Singaporeans' average lifespan has risen steadily from 81.9 to 83.5 years since 2011, with females typically living longer. With longer lifespans, considerations include working beyond 65, adjusting lifestyle, managing retirement savings to avoid depletion, and potential reliance on children for support. Hence, prioritizing retirement planning is crucial in light of these challenges

What happens if we don't start planning ?

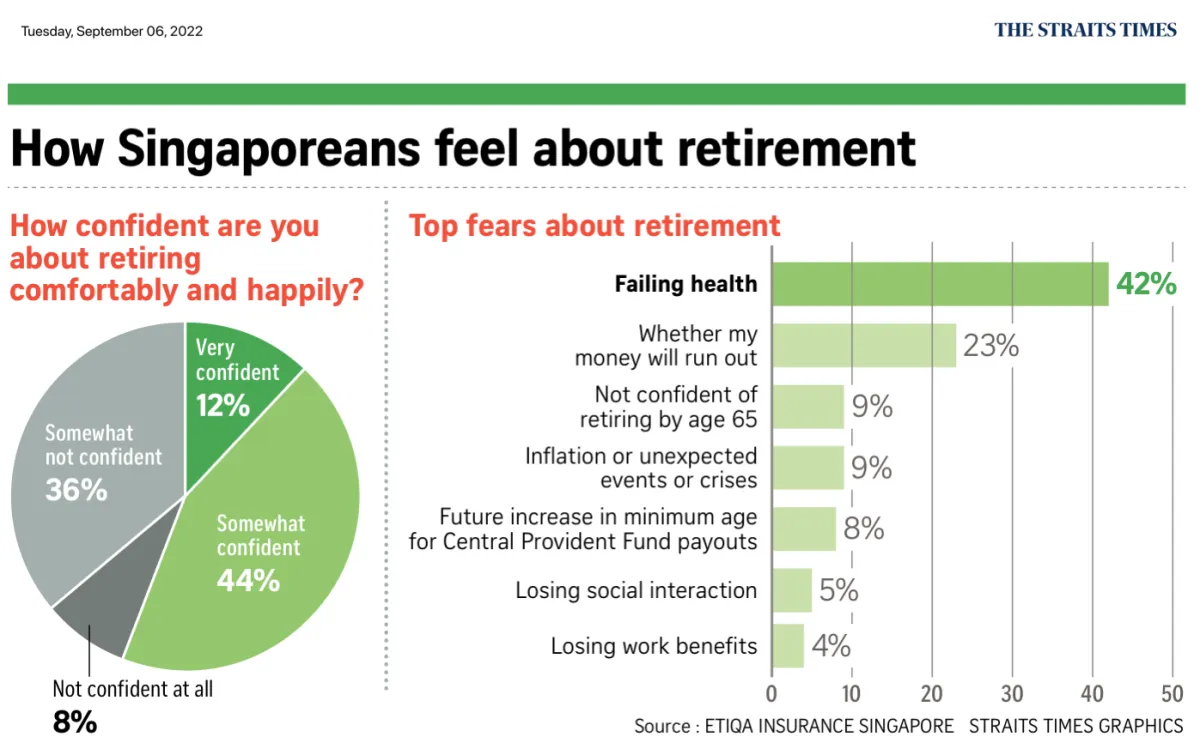

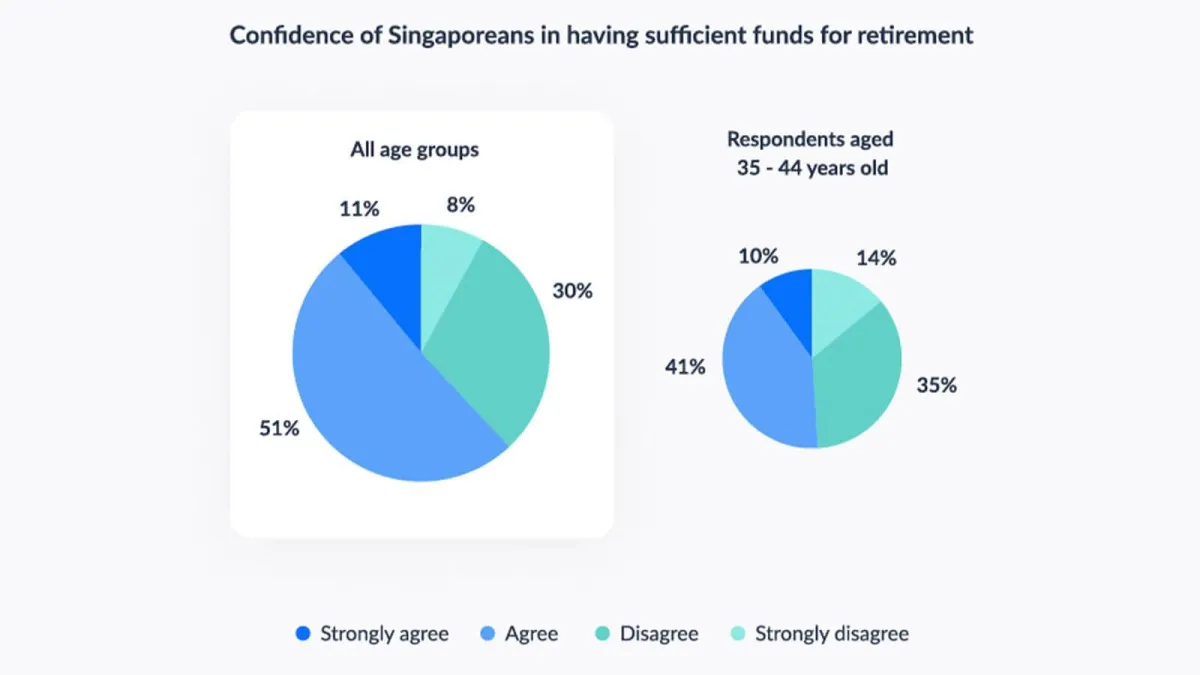

Source: The Endowus Singapore Retirement Report done on May 2021

Despite nine out of ten Singaporeans expressing confidence in retiring by 65, 44% of them doubt their ability to retire comfortably. Primary concerns include declining health and outliving retirement funds.

A report by Endowus shows that 39% of Singaporeans, or one in three, worry about inadequate retirement funds, with many not taking proactive steps to address this concern. Notably, 49% of respondents aged 35 to 44 lack confidence in their retirement readiness.

WHY WORK WITH MINDY?

Hey, it’s Mindy here and for the past 6 years I have been helping many families to achieve their retirement goals through asset wealth.

Using my proven APR framework, I’ve helped many families unlock substantial profits from their HDB and accelerate their retirement sooner than they expected.

Traditionally, many Singaporeans bought HDB flats using CPF, stayed for around 30 years, then downsized to a cheaper property for retirement. However, due to changes in the current SG real estate market, retiring with a HDB is becoming increasingly challenging.

Many HDB owners overlook the fact that using CPF for their HDB requires repayment with accrued interest of 2.5% compounded yearly. Holding onto the property longer results in higher accrued interest, potentially consuming profits upon selling. This poses a significant problem as it could deplete hard-earned CPF due to accrued interest. In conclusion, the traditional approach of using CPF for HDB and staying for 30 years is no longer viable.

Through my APR framework, I offer a solution to grow your asset wealth by leveraging your current property, aiming for a comfortable retirement with both a home and substantial retirement funds.

Why is growing your wealth important ?

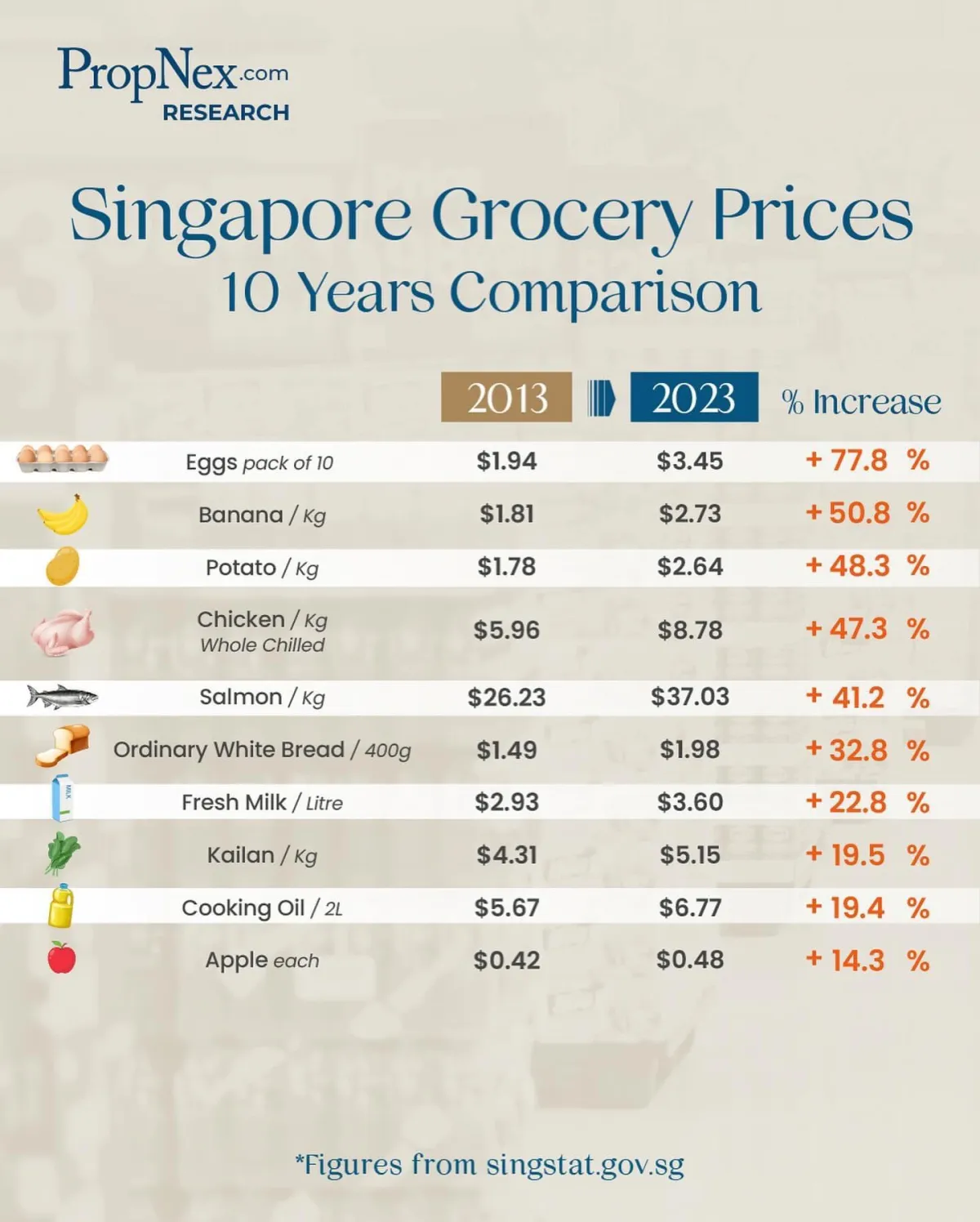

In the last 10 years, food prices have also risen according to the infographics.

In addition, the increase of GST from 8% in 2023 to 9% in 2024, alongside rising prices in various sectors like transportation, utilities, and property tax, has contributed to a higher overall cost of living. Additionally, water tariffs are set to rise in April 2024.

However, stagnant or minimally growing incomes ranging from 2% to 5% annually and interest rates for investments hover around 3% to 3.8%, barely can keep up with inflation.

This scenario underscores the importance of safeguarding against inflation's impact by intensifying efforts and strategically investing funds.

WHAT’S INCLUDED INSIDE THE 1-1 CONSULTATION

How to analyze your current property portfolio and financial situation to craft a tailored retirement plan that aligns with your goals and aspirations.

How to assess whether it's the optimal time to either upsize or cash out your property to mitigate your risk amid the economic uncertainty

How to identify properties with SAFE entry price and upside potential, so you can retire comfortably while still owning a property at the end of the day with my proven APR framework

Get your burning questions answered, ensuring clarity and confidence as you embark on your retirement planning journey.

Total value: S$2,000

You get it for $0

(limited time only)

This FREE consultation is 100% educational. We believe in giving you value first and work with you when you see the value we provide

WHAT PEOPLE SAY ABOUT MINDY

Client #1:

Mr Z

Mr Z upgraded from his 4-room flat and increased his net worth to $800,000. After a few more years, he intends to further upgrade to increase his net worth so that he can retire comfortable when he reaches 55.

Client #2:

Mr and Mrs Tay

After financial planning, Mr. and Mrs. Tan upgraded from their HDB to a 3-bedroom Executive Condo with confidence in their finances. Within 6 years, they doubled their net worth from $600k to $1.2mil, bringing them closer to their retirement goals.